Press Releases

March 1, 2019

DOCOMO and Mizuho Bank Testing Network-Connected Auto Loan Service in Indonesia

— Trial combines financial information and car location data to optimize loan services —

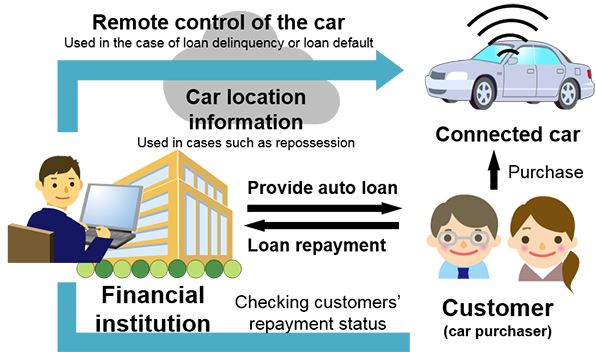

TOKYO, JAPAN, March 1, 2019 --- NTT DOCOMO, INC. and Mizuho Bank, Ltd. announced today that they are jointly conducting a proof-of-concept trial in Indonesia through their respective local subsidiaries from March 1 to November 30 to test an advanced financial service --- network-connected auto loans. The service combines data from an in-vehicle device tracking the vehicle's location and financial information held by Mizuho Bank with the aim of helping financial institutions to optimize the management of their car loans.

Indonesia, a country of around 260 million people, is expected to enjoy continued strong economic growth. As income levels rise, personal transportation preferences will likely shift from two-wheeled to four-wheeled vehicles, which should result in a rising demand for auto loans. At the same time, financial institutions that provide auto loans are faced with the challenge of reducing loan delinquencies and defaults, as well as ensuring the smooth recovery of vehicles after defaults occur. This trial seeks to determine the extent to which these issues can be solved by using an in-vehicle device with remote engine control and location tracking capabilities.

The trial service is one of the latest examples of DOCOMO's efforts to collaborate with partners to interconnect cars and data for diverse value-added services that enrich the experience of automotive transportation. Mizuho is leveraging its expansive financial expertise to support economic growth in Asia by expanding its retail financial services outside Japan and creatively using data acquired through new technology.

Going forward, DOCOMO and Mizuho aim to expand the service both within Indonesia and throughout the ASEAN region as well as jointly develop a variety of data-driven businesses. The proof-of-concept trial will enable them to acquire valuable insight and expertise regarding the potential for connected auto loan services as well as additional financial services based on the combination of financial and vehicle movement data.

Overview of Trial

| Trial | Proof-of-concept trial for network-connected auto loan service |

|---|---|

| Timeframe | March 1 to November 30, 2019 |

| Details |

|

| Target area | Jakarta metropolitan area, Indonesia |

| Target customers | Approximately 200 customers |

| Main items being evaluated |

|

Service Concept